Repayment & Reinvestment Questions

The Solar Businesses in which you have invested make solar home systems (SHS) available to African families under affordable hire-purchase agreements. As African families make monthly payments to the Solar Businesses, they in term can return money to you. We’ve designed a bond product that allows Solar Businesses to return invested capital to their investors on a 6-monthly basis. This is known as an Amortizing loan, and while this might sound complicated, the benefit to Solar Businesses is that they never have to borrow more than they need at that moment in time.

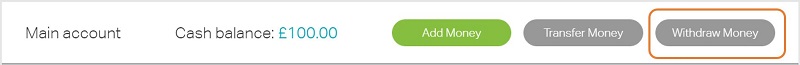

If you decide not to reinvest at this time it might be sensible to withdraw money to your bank account. You can withdraw money from the Portfolio section of your account using the grey ‘Withdraw Money’ button:

Once you’ve added the money to your wallet, you can place another order for bonds and when it comes to the payment screen just choose the option to ‘Pay from wallet’.

To invest this money using the ‘Invest Now’ or ‘Invest with IF ISA’ button accordingly. Money on your wallet can be used in payment for new orders when you come to the payment screen.

Investor Guarantee FAQs

Energise Africa IFISA

Before opening an IFISA with Energise Africa you need to register with us and complete the set up of your account. Once complete you will see an ISA section within the dropdown menu in the top right-hand corner with the option to “Open a new ISA” which will take you to the relevant page. Please read and agree to the Energise Africa IFISA T&Cs and enter your National Insurance number. Click on "Continue" to complete the process.

Once you have clicked “Invest” on the offer profile you will be taken to a copy of the project’s offer document. At the bottom of this page there will be an option to “Invest within IFISA” which you must select if you want the investment to be held in your Energise Africa IFISA.

There are no fees for opening, making investments, transferring out or withdrawing funds from your Energise Africa IFISA.

To transfer funds from another ISA provider, simply select Account --> IFISA --> New ISA Transfer, and fill in your current ISA provider’s details and the amount you wish to transfer. Print, sign and upload your form via the messaging system. You can also post the form to our ISA managers (ShareIn Ltd) at the following address; ShareIn Ltd, Argyle House, 3 Lady Lawson Street, Edinburgh, EH3 9DR. Once received, ShareIn will contact your existing ISA provider to have the requested funds transferred to your Energise Africa IFISA “wallet”.

If you wish to transfer available money from your Energise Africa IFISA to another ISA, you will need to contact your new ISA provider who will instruct you on their procedures. Please inform them that Energise Africa IFISAs are managed by ShareIn Ltd and can be found by searching "ShareIn Ltd t/a Energise Africa".

IFISAs are not treated the same as a standard Cash ISA and don't have a specific account/roll number or sort code. However, if you're unable to complete the transfer form without providing information for that section, you can use "N/A" or "1234". ShareIn will match the account based on your personal details on the transfer form.

It's currently not possible to pay for an order directly via ISA transfer. We therefore ask that you go through the process of transferring money from an existing ISA before placing an IFISA order for investment. Once completed, the money will be available in your IFISA “wallet” ready for investment.

No, it's not possible to move an existing investment into your Energise Africa IFISA.

If you decide to not proceed with an investment and request to cancel the order, the money will be returned to your IFISA account. Any current year subscription money used towards the order will still count towards your ISA allowance at that point, however the Energise Africa IFISA is fully flexible so withdrawing the money from your IFISA account will remove it from your current year ISA allowance.

Your eligibility to hold returns tax-free within an IFISA is dependent on your own personal tax status, and investing within an IFISA does not guarantee you will make a return on your investment.

An IFISA does not reduce the risk of the investment or protect you from losses, so you can still lose all your money. It only means that any potential returns will be tax free. If any of the parties involved in the arrangement, Energise Africa or ShareIn Ltd (ISA manager), enters a wind down scenario, there is no guarantee that you will be able to transfer your ISA holdings to another ISA provider and therefore your ISA wrapper may be lost. An ISA transfer may involve costs for which neither Energise Africa nor ShareIn bear responsibility. If any of the parties involved in an ISA investment winds down, returns (both capital and any interest or profit) may be adversely impacted.

Crowdfunding Questions

Crowdfunding is a method of funding a project or organisation by pooling the money of individual investors. It can provide a number of benefits beyond the financial including marketing, audience engagement and feedback. Crowdfunding allows good companies which don't fit the pattern required by conventional financiers, to break through and attract cash. There are a number of types of crowdfunding but the 3 main categories are:

- Reward or donation based crowdfunding – these are not investments

- Debt crowdfunding (sometimes referred to as loan-based or peer-to-peer crowdfunding)

- Equity crowdfunding

The investment opportunities offered on Energise Africa are all debt security crowdfunding projects.

Want to know more?

Please visit the UK Crowdfunding Association.

Debt security crowdfunding is the process whereby individuals or the "crowd" loan money to a business at an agreed interest rate over a set period of time. The crowd can be issued with a bond in return for their investment (as happens with all investment opportunities listed on Energise Africa).

Debt security crowdfunding is a great way for companies who need to raise cash, but who may not fit the traditional lending requirements of financial institutions, to raise loan finance.

Yes – debt crowdfunding is a regulated activity in the UK and each country across the world has specific regulations regarding the adoption of debt crowdfunding.

The Financial Conduct Authority (FCA) in the UK issued a Policy statement (14/4) The FCA's regulatory approach to crowdfunding over the internet, and the promotion of nonreadily realisable securities by other media, in March 2014.

Investing in the debt of companies such as those listed for investment on Energise Africa involves risks. If the business you are investing in fails, there is a high risk that you will lose your money. Many bonds last for several years, so you should be prepared to wait for your money to be returned even if the business you're investing in repays on time. You are unlikely to be able to cash in your investment early by selling your bond. Putting all your money into a single business or type of investment for example, is risky. Spreading your money across different investments makes you less dependent on any one to do well. This type of investment is only for investors who understand these risks.

A full risk warning can be found here.

We do not offer tax advice and would recommend seeking independent tax advice.

The exception to this requirement is where interest is paid to investors who hold bonds within an IFISA, in which case interest can be paid without deduction of tax.It remains the individual investors responsibility to declare any interest paid and account for any additional tax that may be due to the appropriate tax authorities.

No. You can lose all the money you invested but nothing more.

Investors should be aware that investment in bonds issued by companies listed on www.energiseafrica.com carries risks as well as the possibility of returns. If the business you are investing in fails, there is a high risk that you will lose your money. Advertised rates of return aren't guaranteed This is not a savings account. If the borrower doesn't pay you back as agreed, you could earn less money than expected. Many bonds last for several years, so you should be prepared to wait for your money to be returned even if the business you're investing in repays on time. You are unlikely to be able to cash in your investment early by selling your bond. You are usually locked in until the business has paid you back over the period agreed.

- Restricted Investor (you agree to invest no more than 10% of your net assets in investments that cannot be easily sold)

- Self-Certified Sophisticated Investor (made more than one investment in an unlisted company in the last 2 years)

- High Net Worth Individual (income > £100,000 or net assets > £250,000)

Individuals outside of the UK may register with Energise Africa but before placing an order to invest should be aware that certain countries may impose restrictions on the ability of their nationals to invest overseas and consent may be required or taxes due locally. We are not cognisant with these restrictions and so ultimately when you make a decision to invest we need to make it clear to you that it is your responsibility to be aware of any restrictions your country of residence may impose, and that Energise Africa cannot be held liable.

Investment opportunities listed on Energise Africa are not open to residents or citizens of either Canada or the United States of America.

When you invest or top up your wallet, funds should be transferred to 'ShareIn Ltd'. ShareIn Ltd holds client monies in segregated accounts. ShareIn Limited (Firm Reference Number 603332) is authorised and regulated by the Financial Conduct Authority. The transfer details will be available at the time of investing.

ShareIn provide payment services for the Energise Africa website.

No. We'll never make your personal details public. Your data will only be shared in accordance with our Privacy Policy.

Please note that due to local laws and/or reporting requirements we are unable to accept investment from Canada or the United States of America. US nationals resident outside of the US are unable to invest due to FATCA reporting requirements. This is not related to restrictions imposed on US persons under Reg S.

For other countries, we would be more than happy to enter into separate discussions as to whether we can accommodate your investment. It will be dependent on your particular circumstances and the regulatory framework in your country of residence. Please contact us at help@energiseafrica.com if this interests you.

We give investors the option to:

- fund the wallet linked to your account in advance and then use monies in this wallet to pay for your investment

- let us know you will be sending payment by bank transfer after you have placed your order (in this instance we would ask you to arrange the bank transfer as soon as possible so that we have monies on account to transfer to the Solar Company that you are investing in as soon as the offer closes)

All UK investors using this platform are eligible to file a complaint to the Financial Ombudsman Service. There is no cover under the Financial Services Compensation Scheme (FSCS) for investments into the products offered by Energise Africa. Before your money is invested or once the proceeds of investments are returned, it will be held by the money recipient in a segregated client bank account and subject to the separate FSCS protections applicable to credit institutions and banks.

Different regulations apply in different regions and before being able to invest you will be asked to confirm that you meet the eligibility requirements in your particular region.

There are no fees charged to you (the investor) for making investments on www.energiseafrica.com

You have a 14 day 'cooling off' period in which you can cancel your order to invest. The cooling off period begins from the time at which you submit your order to invest into a Bond Offer listed for investment on Energise Africa.

At any time during this 14 day period you can notify us of your wish to cancel your investment by contacting us at orders@energiseafrica.com. If you have already made payment for your investment then the monies will be refunded in full to your investment account. It is your own responsibility to withdraw these monies to your nominated bank account if you so wish.

We want to give you superb customer service but sometimes things might go wrong. We can usually resolve most issues straightaway, so please email us on help@energiseafrica.com to tell us how we can help.

Full details of our complaints procedure can be found in the Complaints section of this website.

One of your rights under data protection law is the right of access to the personal data that we hold about you. The process of requesting your data is called a Subject Access Request (SAR).

How to ask for a SAR

If you want a copy of the personal data we hold (or simply want confirmation as to whether or not we process data about you), you must make a request, either in writing or verbally. Our contact details are here.

Please include the following in your SAR:

-

Your full name, postal address, email address and telephone number

- The statement “I the undersigned and the person identified above hereby request that Lendahand Ethex (1) inform me of the personal data held about me OR (2) provide me with a copy of the personal data Lendahand Ethex hold about me.”

- [If request made in writing] Signature and date

What you can expect from us

Before releasing personal data we may have to take steps to confirm your identity. This could include requiring a piece of photo identification or answering a number of security questions related to your account.

Once we verify your identity, we will log your request, and we will search all databases to find any personal data we currently hold.

We will provide an electronic copy of your personal data within a month of your request.

Please be aware that there are circumstances in which the law allows us to extend the response time or charge an administrative fee. In either case, we will inform you by email within one month of receiving your request.

What you can do once you receive the data we hold

Once you receive the data we hold, you have the right to ask for data to be corrected or erased.

Please be aware that we may not always be able to erase personal data we may hold about you. If your personal data relates to an investment you have made, financial services regulation requires us to keep certain information on file for a period of 5 years.

In the event you have a complaint about the way we have handled your personal data or your SAR, you can count on us to take your complaint seriously.

If you feel your data protection rights have been violated and you do not feel you have had a satisfactory response from us , you have the right to lodge a complaint with the Information Commissioner’s Office (ICO).

Further information about the Energise Africa IF ISA can be found here. Information on transferring an existing ISA balance to us can be found here.

If you would like more information about our IF ISA please send an email to help@energiseafrica.com.